Today, we delve into the intricate dynamics driving the Axis Bank share price, analyzing the myriad factors that influence its trajectory. In the realm of finance, the fluctuations of share prices serve as a barometer, reflecting the pulse of the economy and investor sentiment. One such entity that garners attention is Axis Bank, a prominent player in the Indian banking sector.

Understanding Axis Bank A Glimpse into its Journey

Before dissecting the present-day share price movements, it’s imperative to grasp the essence of Axis Bank. Established in 1993, Axis Bank has traversed a remarkable journey, evolving into one of India’s leading private sector banks. Boasting a robust presence across various financial verticals, including retail banking, corporate banking, and treasury operations, Axis Bank commands a significant foothold in the market.

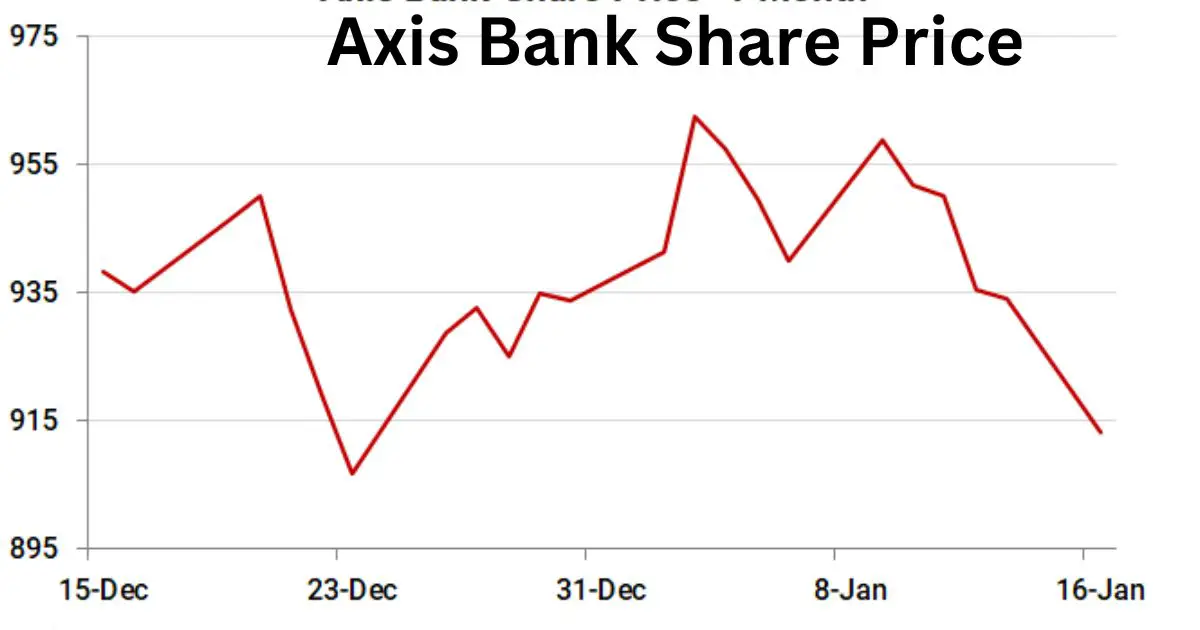

Current Market Scenario Unraveling the Share Price

As investors eagerly track the market, the Axis Bank share price today stands as a pivotal focal point. In dissecting its current state, several key factors come into play:

Macro-Economic Indicators: The broader economic landscape casts a profound influence on Axis Bank’s share price. Macroeconomic indicators such as GDP growth, inflation rates, and fiscal policies shape investor sentiment, thereby impacting stock prices.

Industry Trends: Within the banking sector, industry-specific trends exert a notable sway on Axis Bank’s share price. Factors like interest rate fluctuations, regulatory changes, and technological advancements resonate profoundly, steering investor confidence.

Financial Performance: The fundamental performance of Axis Bank serves as a cornerstone in determining its share price trajectory. Metrics such as revenue growth, profitability ratios, and asset quality metrics scrutinize the bank’s financial health, influencing investor perceptions.

Competitive Landscape: Amidst a fiercely competitive banking landscape, Axis Bank’s position vis-à-vis its peers assumes significance. Comparative analysis of market share, product offerings, and strategic initiatives delineate its competitive prowess, thereby impacting share price movements.

Investor Sentiment: The intangible yet potent force of investor sentiment wields a substantial impact on Axis Bank’s share price. Market perceptions, speculative trading, and psychological factors collectively shape the stock’s volatility and direction.

Navigating Through Price Volatility: Strategies and Insights

Given the inherent volatility in share prices, investors seek to navigate through the turbulence armed with astute strategies and insights:

Fundamental Analysis: Delving into the bank’s financial statements and performance metrics through fundamental analysis offers a holistic perspective. Scrutinizing aspects such as earnings growth, return on equity, and debt levels enables investors to gauge the intrinsic value of Axis Bank’s shares.

Technical Analysis: Harnessing the power of technical analysis unveils patterns and trends within Axis Bank’s share price movements. Charting tools, moving averages, and relative strength indicators aid in identifying optimal entry and exit points, empowering investors with actionable insights.

Risk Management: Prudent risk management strategies form the bedrock of successful investing. Diversification across asset classes, setting stop-loss orders, and adhering to disciplined investment frameworks mitigate downside risks associated with Axis Bank’s share price volatility.

Long-Term Vision: Adopting a long-term investment horizon fosters resilience amidst short-term price fluctuations. By focusing on Axis Bank’s underlying business fundamentals and growth prospects, investors can weather market volatility and capitalize on wealth creation opportunities over time.

The Road Ahead Prospects and Challenges

Looking ahead, Axis Bank navigates a landscape fraught with both opportunities and challenges:

Digital Transformation: Embracing digitalization emerges as a transformative imperative for Axis Bank, enabling enhanced customer experiences and operational efficiencies amidst evolving technological paradigms.

Regulatory Environment: Adapting to regulatory mandates and compliance standards remains a pivotal challenge for Axis Bank, necessitating agile governance frameworks and robust risk management practices.

Market Dynamics: Amidst evolving market dynamics, Axis Bank endeavors to fortify its competitive positioning through innovative product offerings, strategic partnerships, and customer-centric initiatives.

Global Headwinds: External factors such as geopolitical tensions, global economic slowdowns, and currency fluctuations pose external headwinds, necessitating proactive risk mitigation strategies by Axis Bank.

In essence, the Axis Bank share price today epitomizes the confluence of macroeconomic forces, industry dynamics, and investor sentiment. By unraveling the intricacies of its price movements and charting a course guided by prudent strategies, investors can navigate through the volatility with resilience and foresight. As Axis Bank embarks on its trajectory amidst a dynamic landscape, the journey unfolds with opportunities beckoning amidst challenges, embodying the essence of financial markets’ perpetual ebb and flow.